Hello!

era92 Finance

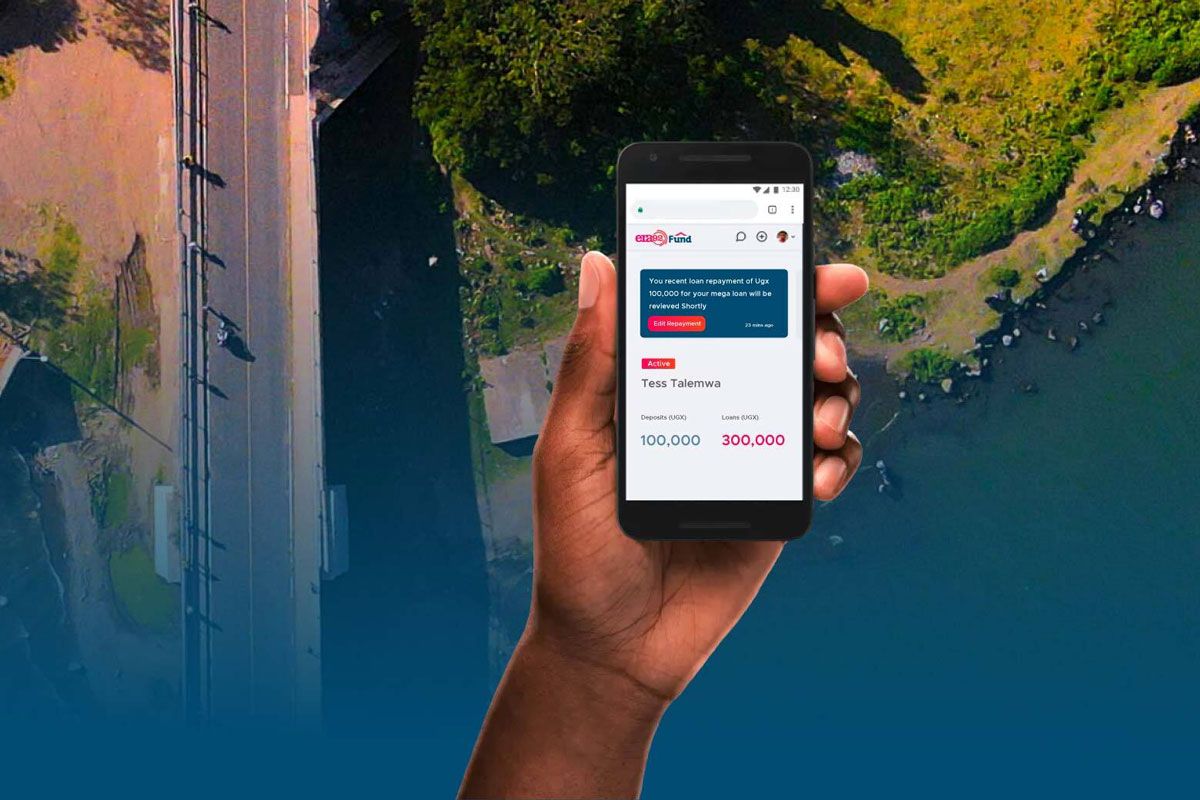

DIGITAL MICROFINANCE

era92 enables the underbanked to access

credit and build a credit history

Say Hello!

to era92 Finance

DIGITAL MICROFINANCE

era92 enables the underbanked to access credit and build a credit history

The Problem: Credit Access In Uganda

Individuals living in some of the world’s most challenging economies have long been unbanked. In fact, 1.7 billion people globally do not have access to formal financial services; 56 percent of them are women. More than 200 million micro, small and medium-sized enterprises in emerging economies lack adequate financing to thrive and grow. Without access to financial services, the world’s poor struggle to start or expand a business, save for a child’s education, pay for health care, plan for the future or cope with unexpected emergencies.

Today, more than 2 billion people are considered financially excluded meaning they have no access to formal financial services. Yet having access to basic services such as savings, bank accounts or credit can transform the lives of those living in the poorest communities, especially young people and women, reducing poverty, increasing social equality and giving them the opportunity to fulfil their potential.

In Uganda alone, it’s still hard for 20+ Millions Ugandans to access capital from banks today.

As a social enterprise, we recognise the zealous young adult who has big dreams but lacks assets or even security to build that which they envision, simply because the available banking services aren’t designed for them.

Similarly,womenlivinginexcludedslumsocietiesfinddifficultyinproving their creditworthiness because they are born poor and live hand to mouth every single day.

In addition to that problem, few major microfinance banks have an app and that’s the bare minimum. Most Microfinance apps are built around limited ideas that are decades old, making them feel like an afterthought.

era92 Finance addresses these problems by providing a hybrid approach that combines both app technology and agent-on-street solutions centered on increasing access to capital for the most excluded.

Affordable, accessible credit for Ugandans who are locked out of the banking system.

era92 Finance is a microfinance lending platform, built for the African Market.

We are a hybrid, app & agent-on-street based microfinance platform in Tier 2/3/4 towns & villages in Uganda, thereby providing last mile credit to excluded individuals who find it difficult to access credit.

We are registered as a microfinance bank that offers Savings and Loans services to Ugandans both in rural and urban settings.

We believe that financial access and control is a fundamental human right enabled through the democratization of capital.

Digitalizing Micro Lending

With era92 Finance, clients can:

- Apply and get their loans approved online with the app

- Easily know how much they have saved and how much they owe

- Quickly register for an account online from anywhere

- Build their credit score so they can borrow more

- Process loans with less paperwork required

Soon members will be able to:

- Have virtual credit cards

- Send money to other members of era92 Finance

- Buy airtime or data using their savings on the app